Real World assets

Real World assets

Real World assets

traded securely

traded securely

traded securely

Our platform provides access to a liquid and trusted trading venue specifically designed for professionals.

Our Mission

Powering an accessible, liquid & regulated market for securities.

Powering an accessible, liquid & regulated market for securities.

Our Vision

Catalysing liquidity for all market participants.

Catalysing liquidity for all market participants.

Our Drive

Building the next generation of trading infrastructure.

Building the next generation of trading infrastructure.

Tokenizations

Challenge

Electronic securities hold immense potential, but unlocking true liquidity remains a hurdle. 360X is here to bridge the gap.

Get access to a curated market

Our experts for art, music and real estate leverage their unmatched expertise to bring you the next generation of tokenized alternative investments.

Get access to a curated market

Our experts for art, music and real estate leverage their unmatched expertise to bring you the next generation of tokenized alternative investments.

Get access to a curated market

Our experts for art, music and real estate leverage their unmatched expertise to bring you the next generation of tokenized alternative investments.

Get access to a curated market

Our experts for art, music and real estate leverage their unmatched expertise to bring you the next generation of tokenized alternative investments.

Access all eWPs (electronic securities) and other RWAs

Our platform lists all eWPs, facilitating investments in tokenized real-world assets with top-tier liquidity, ensuring an unparalleled investing experience.

Access all eWPs (electronic securities) and other RWAs

Our platform lists all eWPs, facilitating investments in tokenized real-world assets with top-tier liquidity, ensuring an unparalleled investing experience.

Access all eWPs (electronic securities) and other RWAs

Our platform lists all eWPs, facilitating investments in tokenized real-world assets with top-tier liquidity, ensuring an unparalleled investing experience.

Access all eWPs (electronic securities) and other RWAs

Our platform lists all eWPs, facilitating investments in tokenized real-world assets with top-tier liquidity, ensuring an unparalleled investing experience.

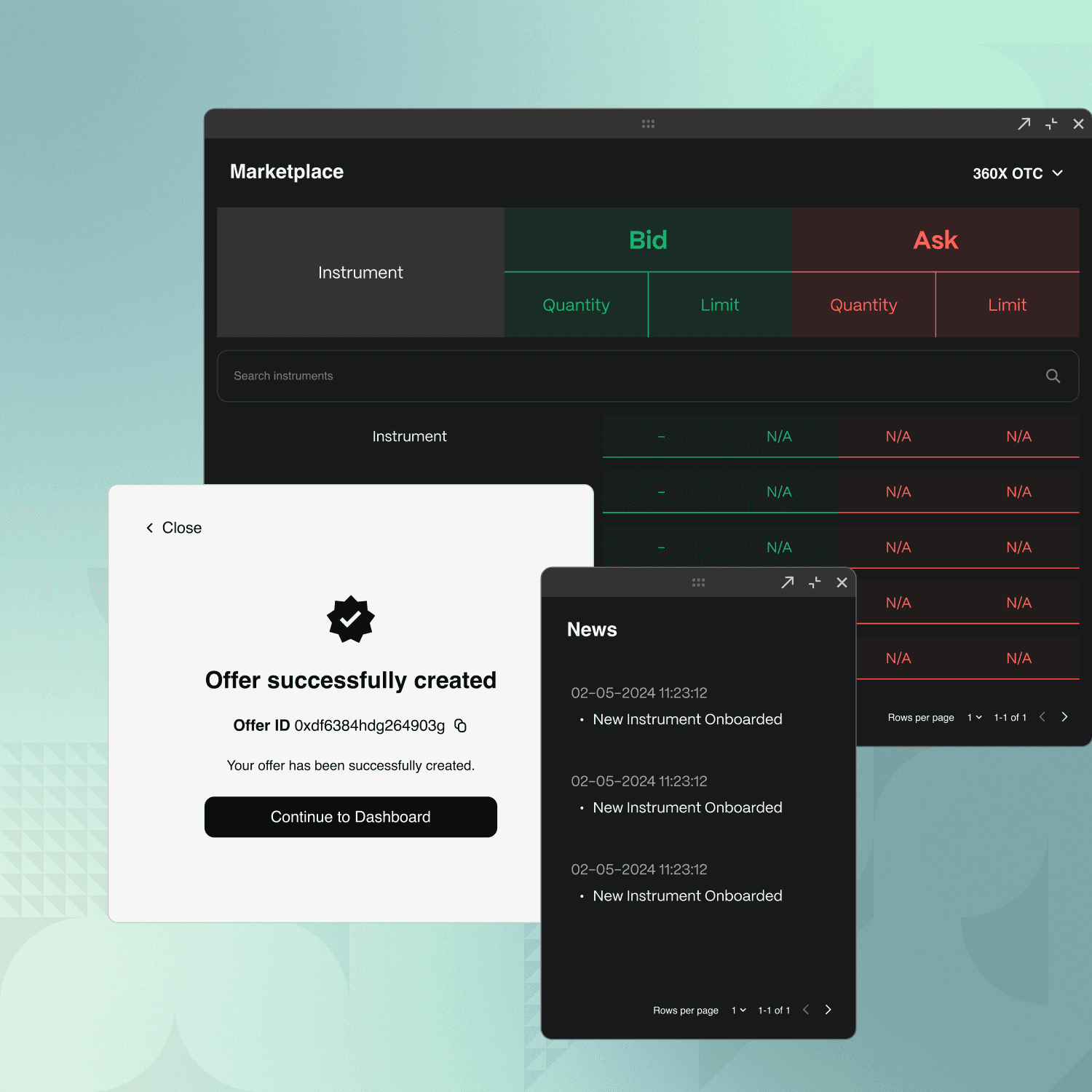

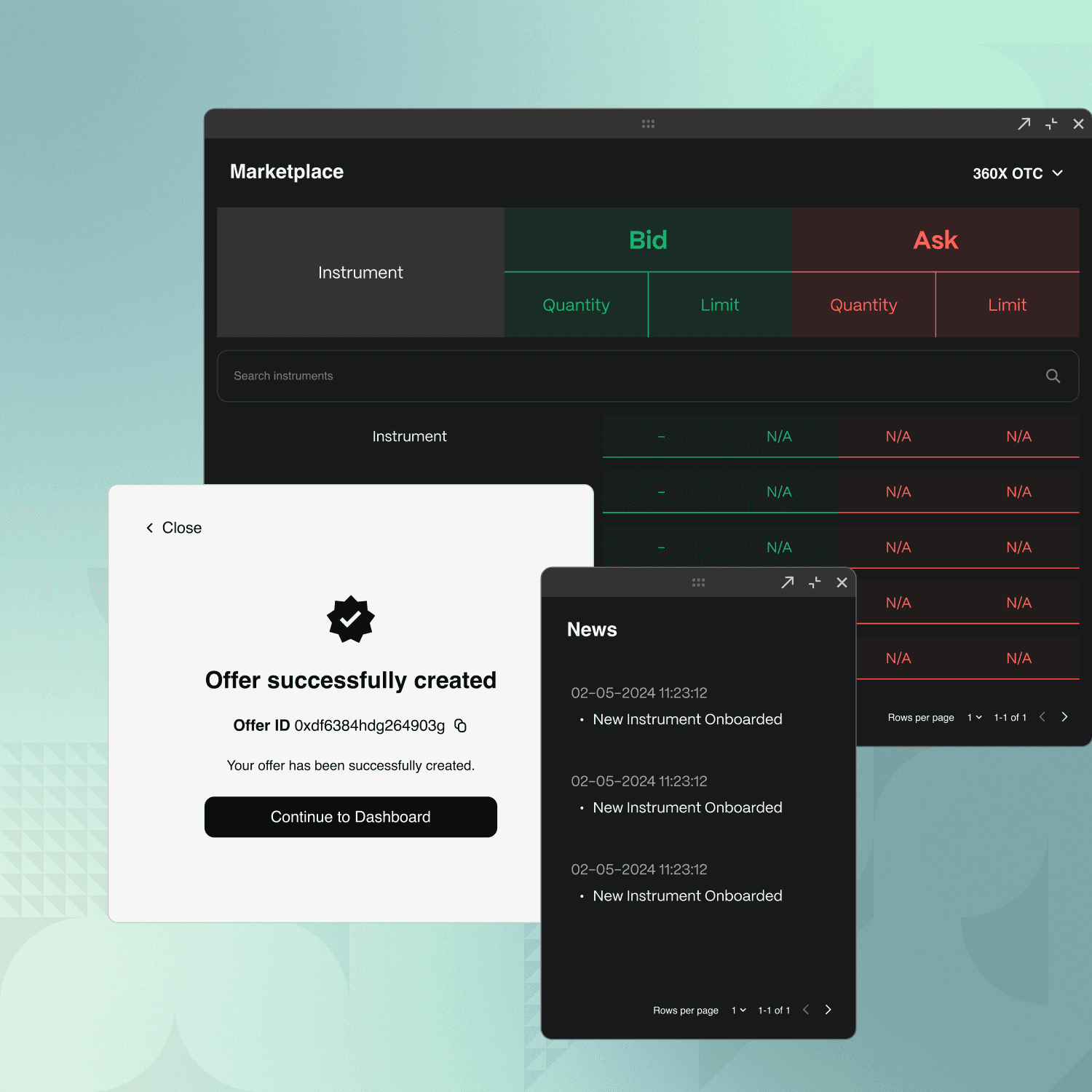

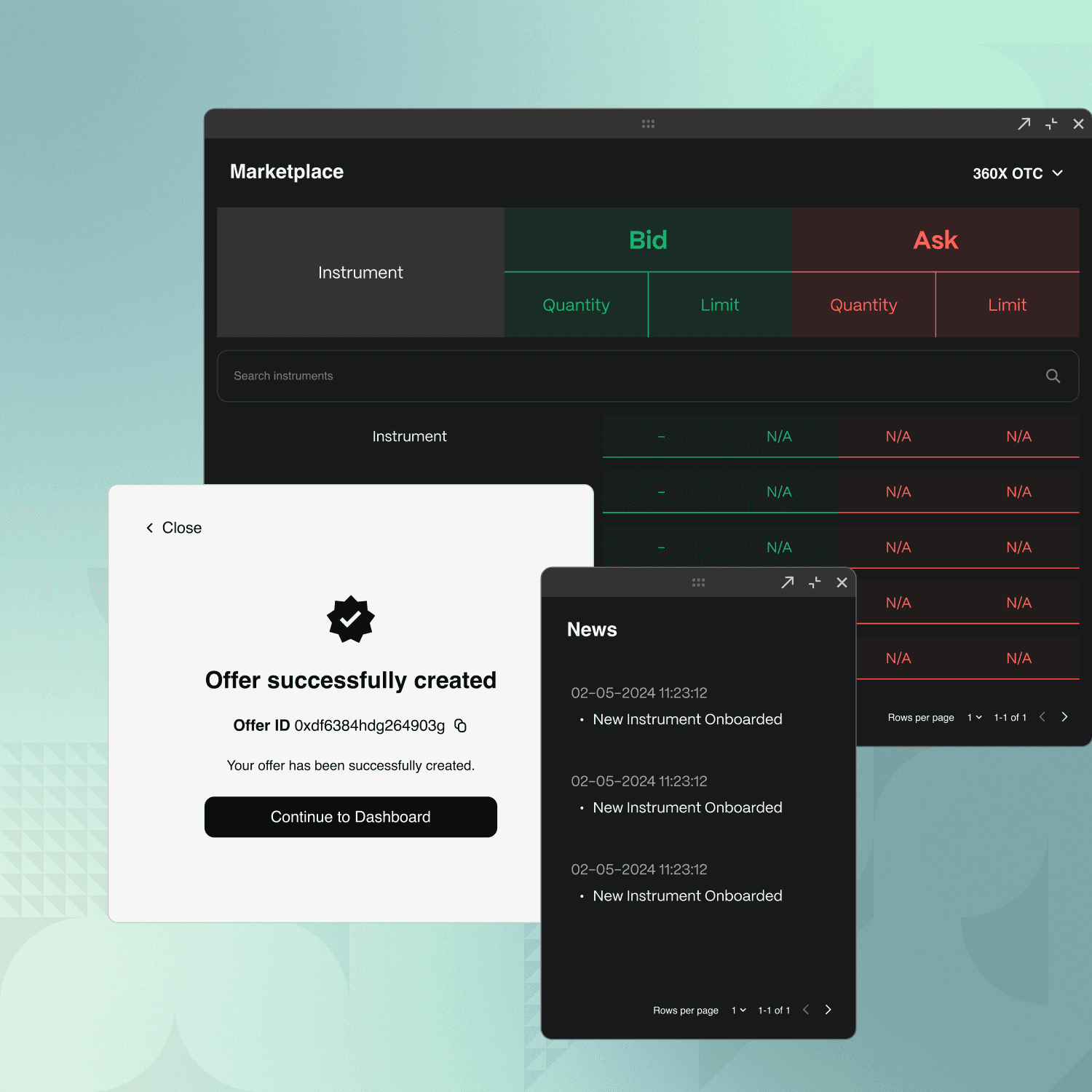

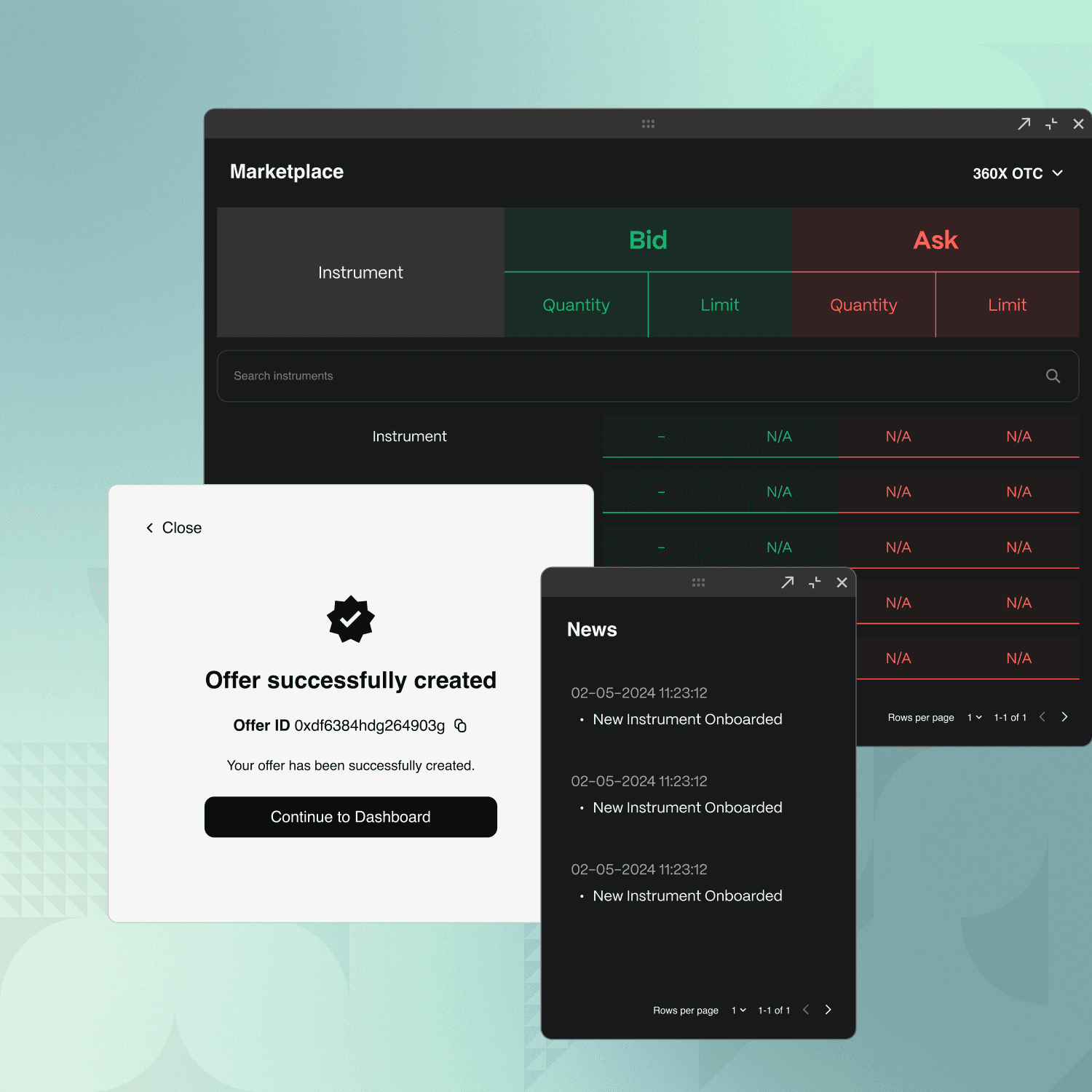

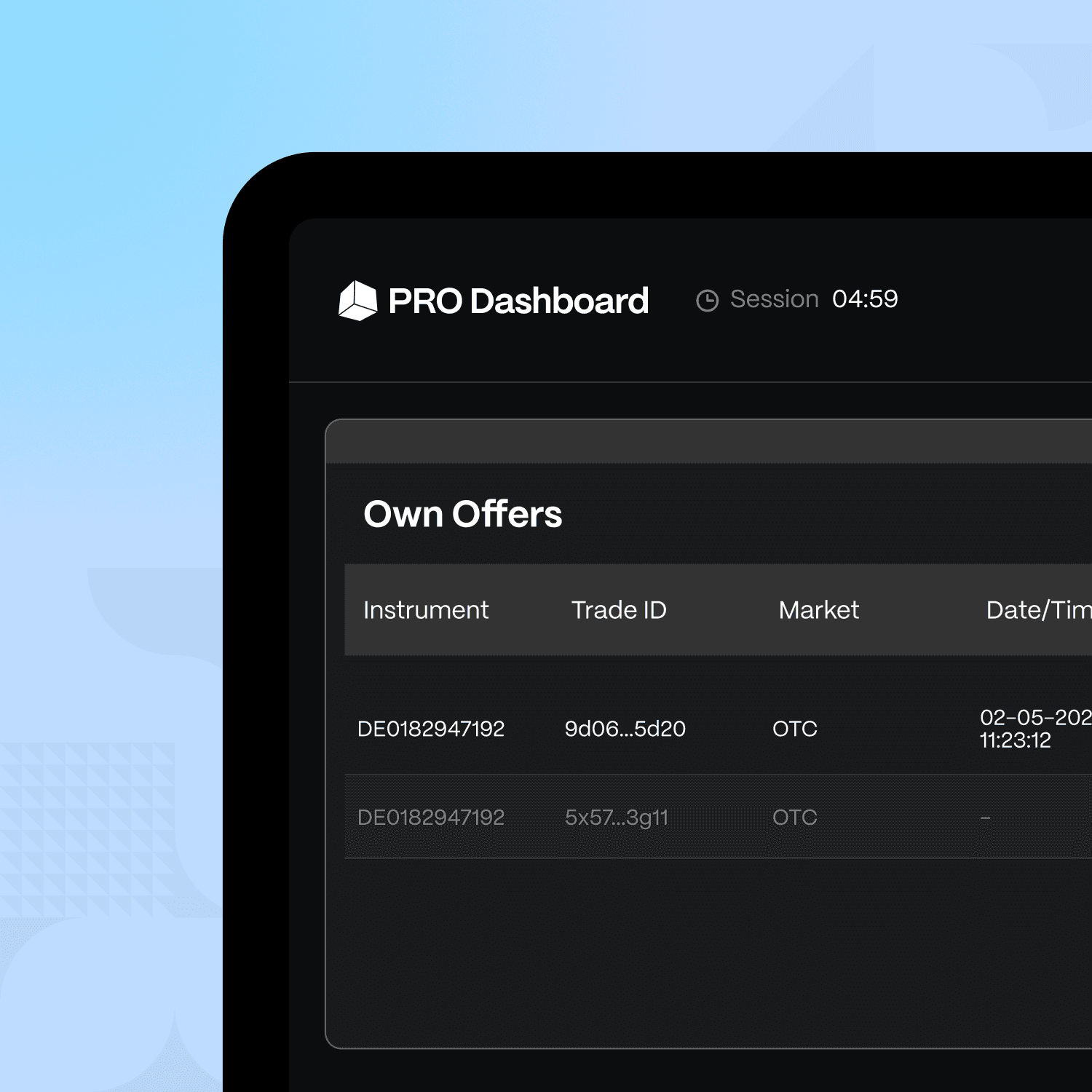

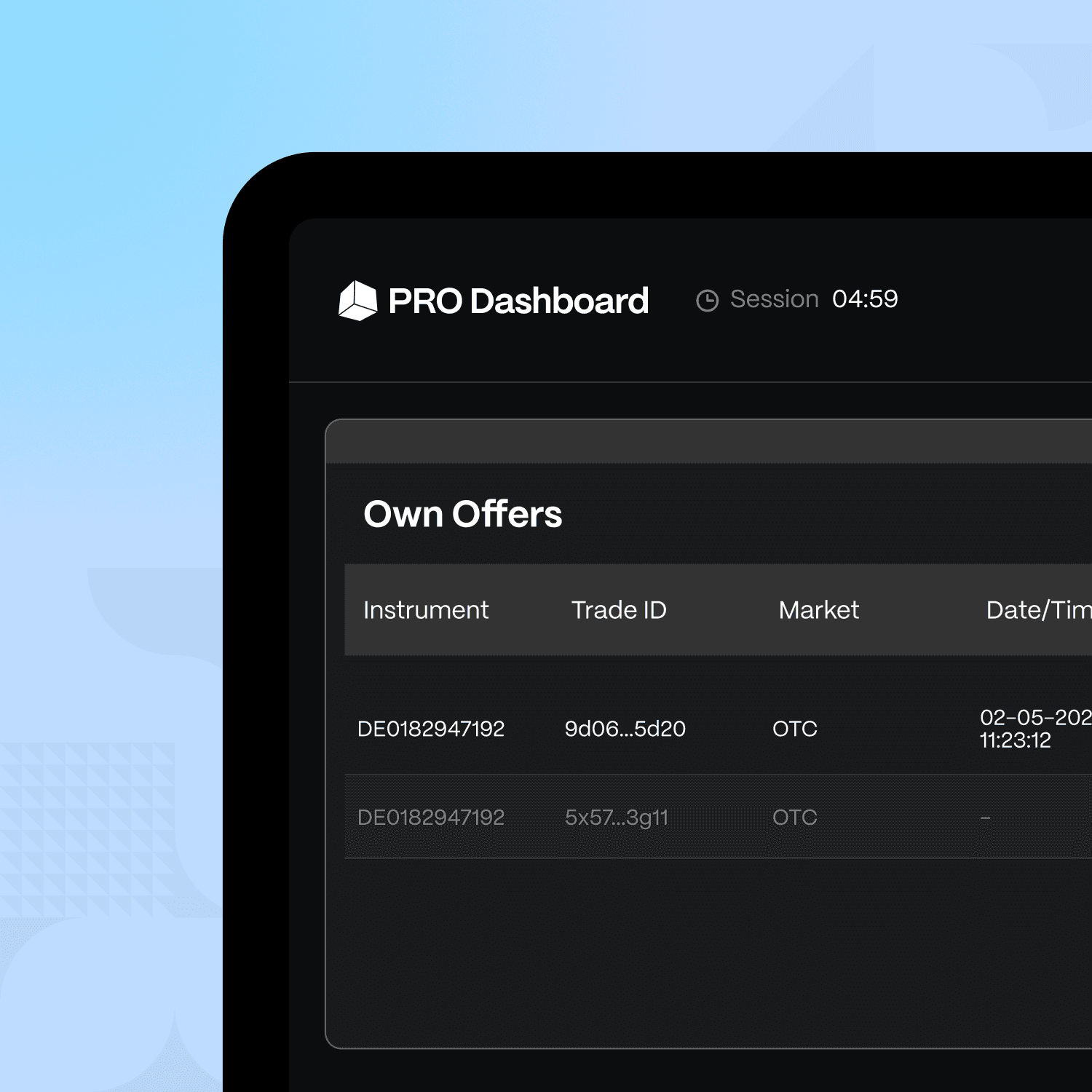

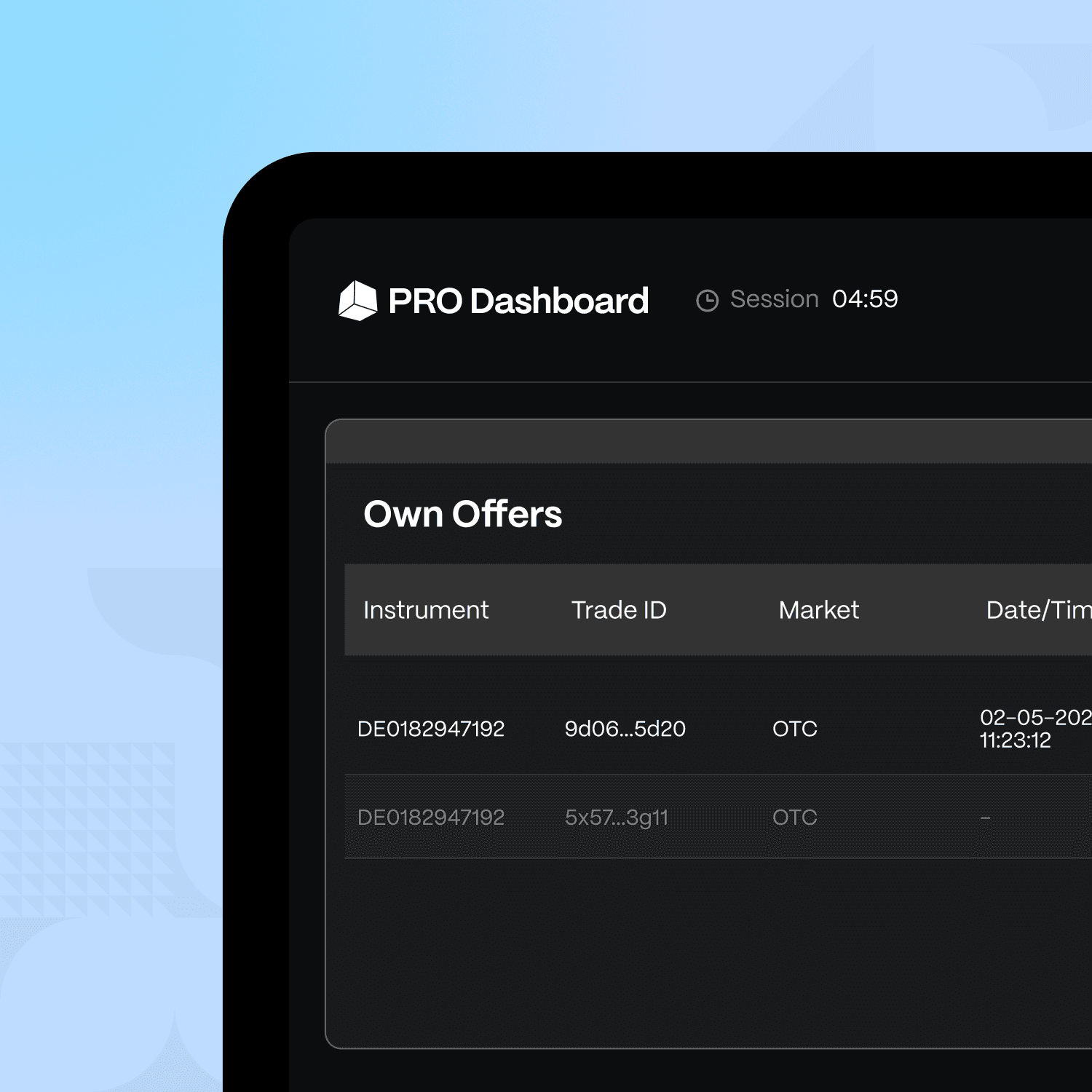

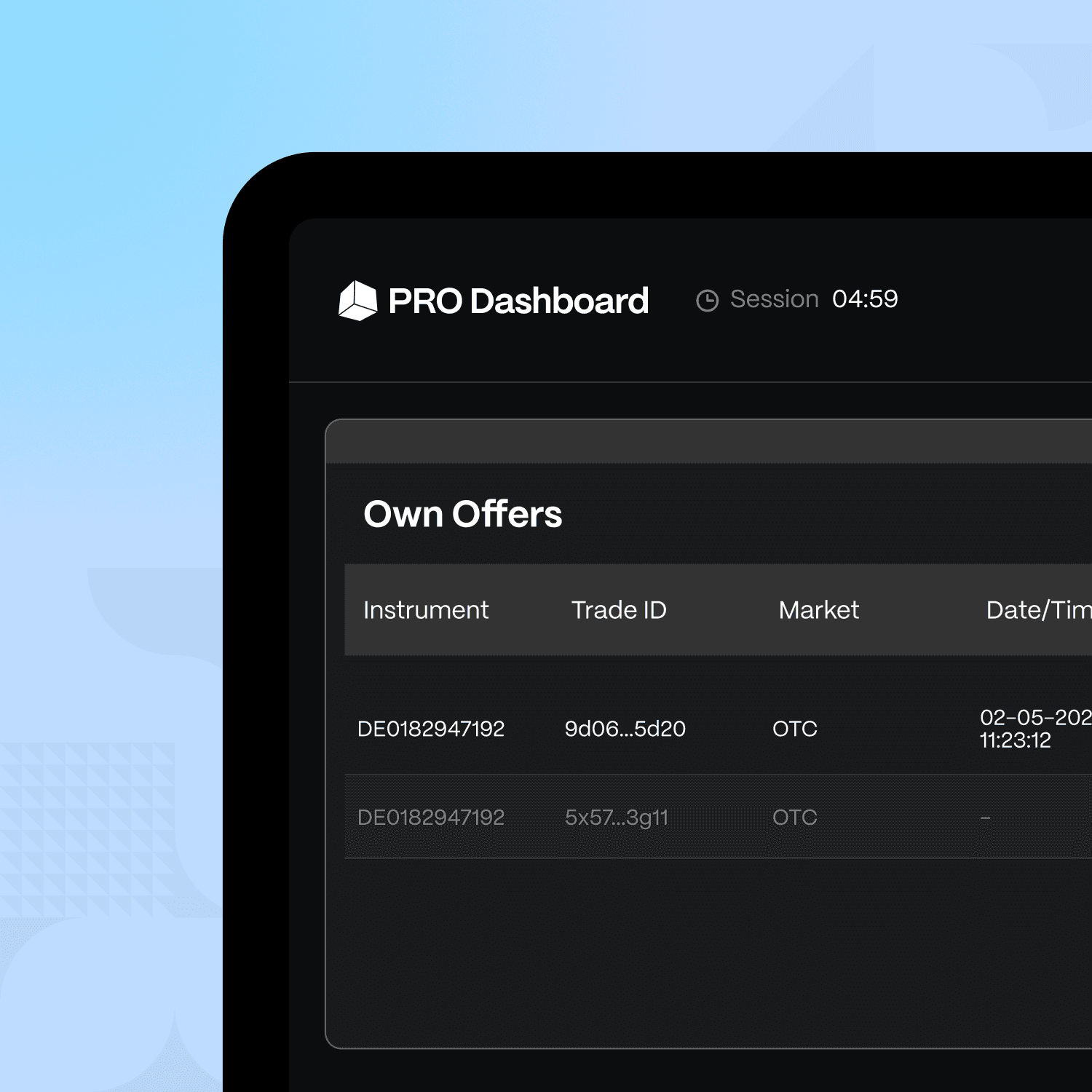

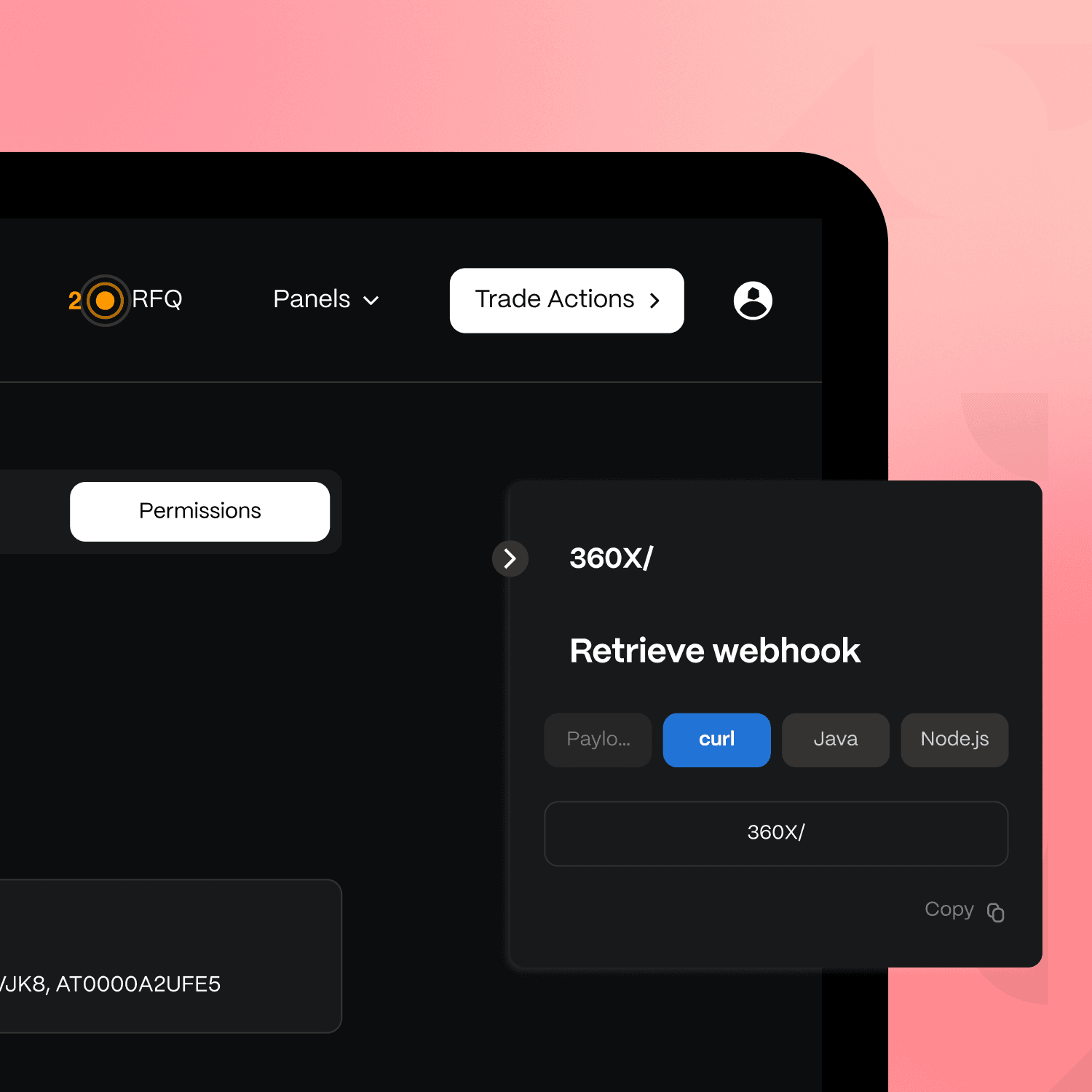

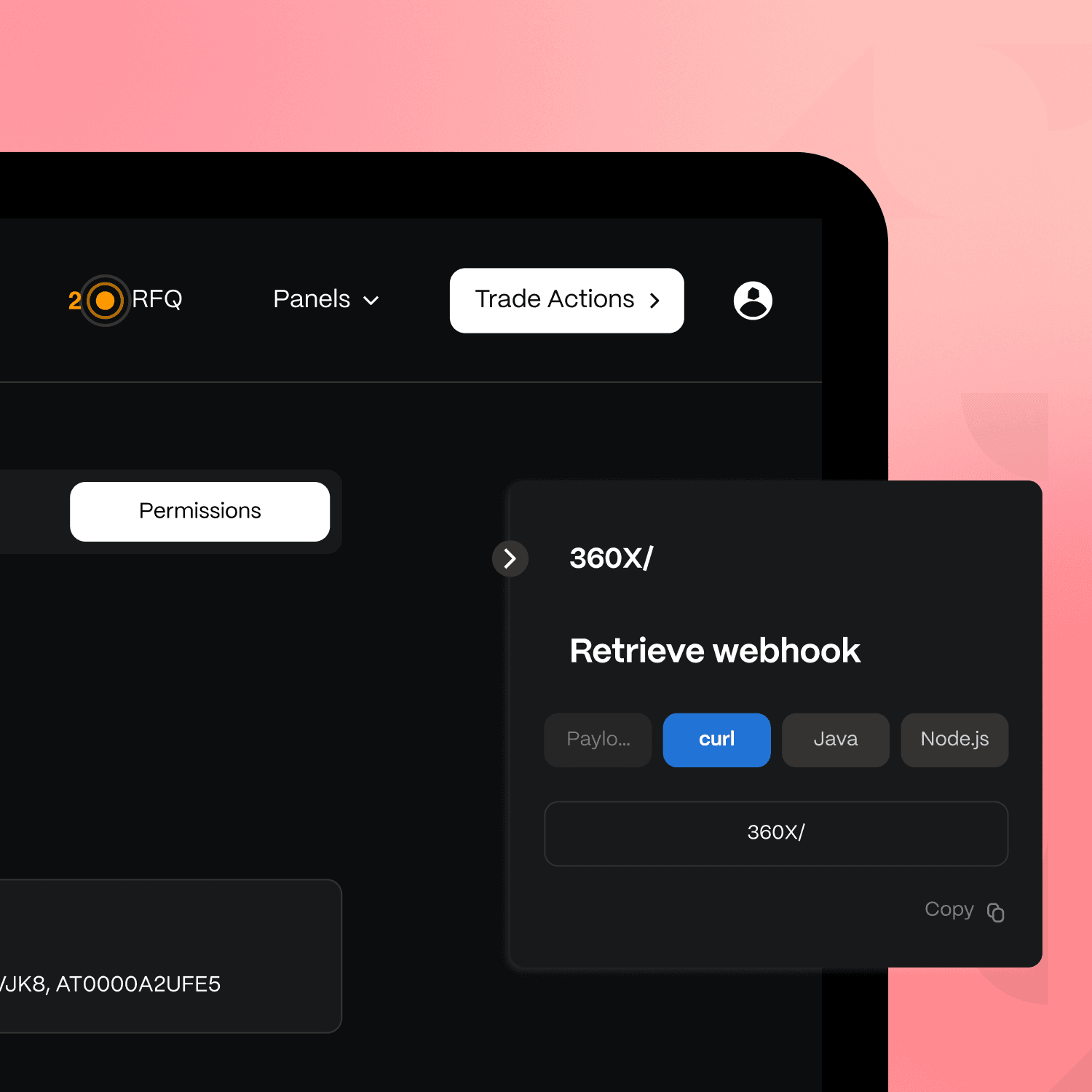

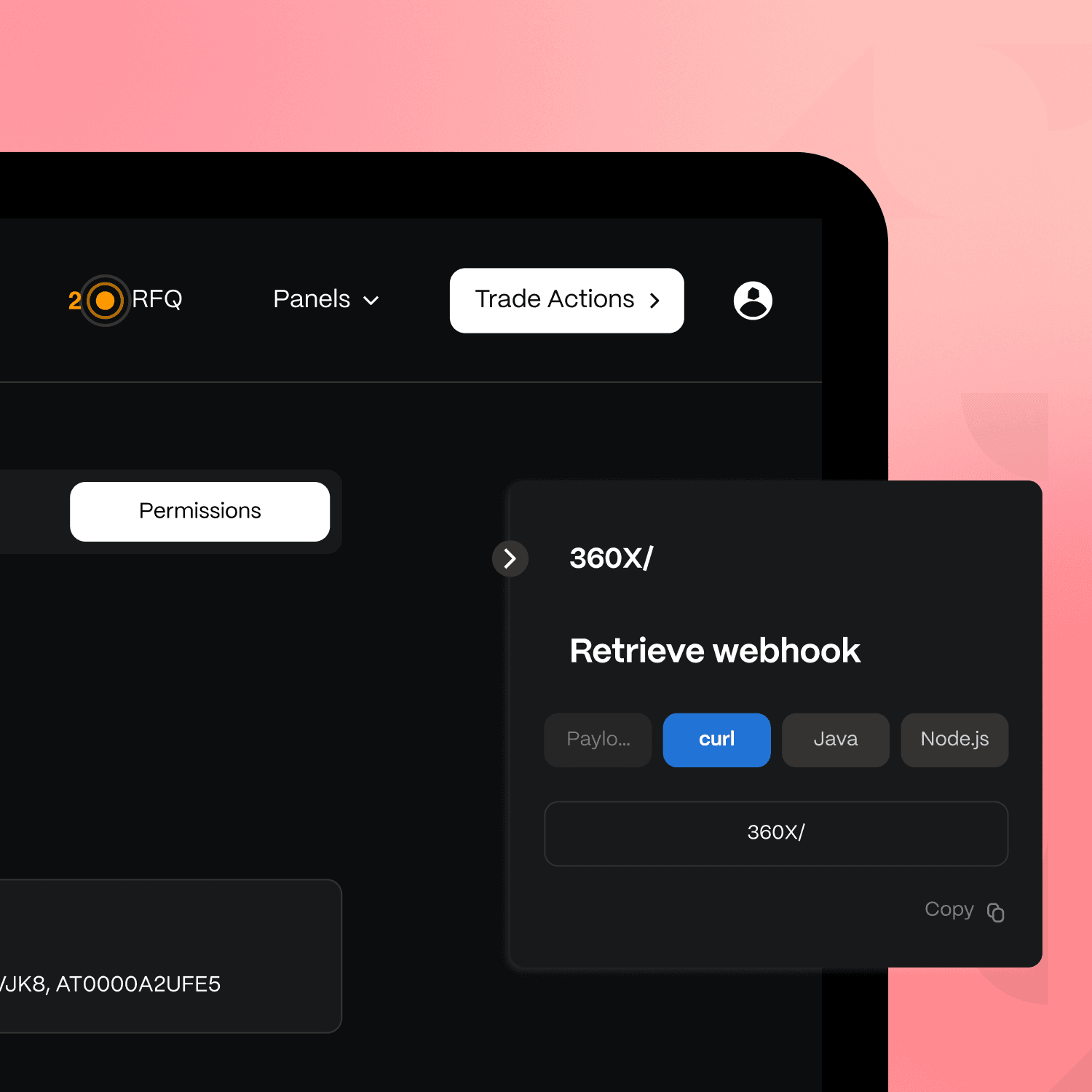

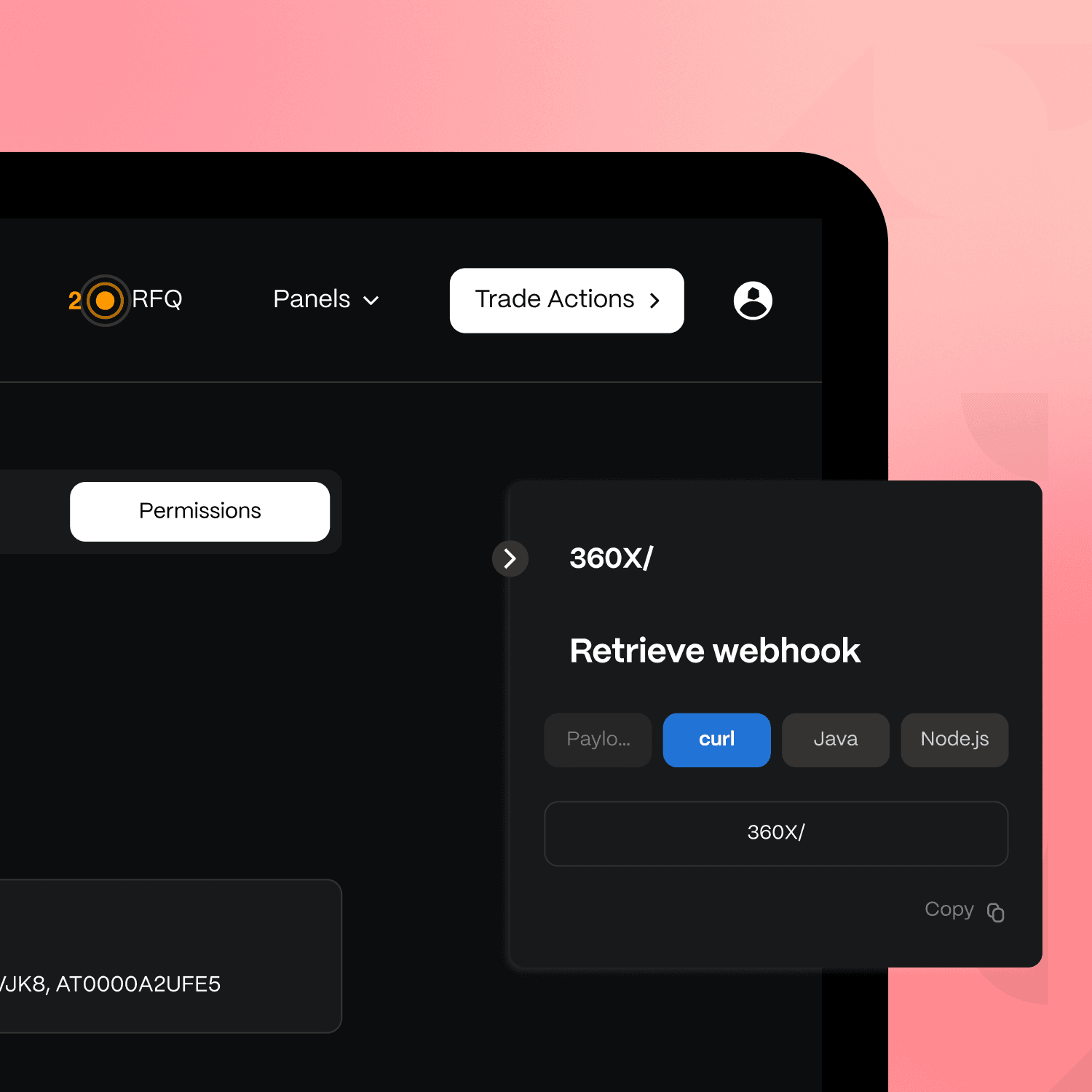

Leverage your pre-existing EMS/OMS

Access our marketplace via industry standard REST API and FIX 5.0 or leverage our PRO Dashboard, specifically designed for trading excellence by experts for experts.

Leverage your pre-existing EMS/OMS

Access our marketplace via industry standard REST API and FIX 5.0 or leverage our PRO Dashboard, specifically designed for trading excellence by experts for experts.

Leverage your pre-existing EMS/OMS

Access our marketplace via industry standard REST API and FIX 5.0 or leverage our PRO Dashboard, specifically designed for trading excellence by experts for experts.

Leverage your pre-existing EMS/OMS

Access our marketplace via industry standard REST API and FIX 5.0 or leverage our PRO Dashboard, specifically designed for trading excellence by experts for experts.

Compliance & Regulation

Our licenses and regulatory compliance establish us as a trusted and dependable partner for professional, institutional and wholesale participants.

Your security is our

priority

priority

priority

priority

Our commitment to regulatory compliance extends to all our partners, guaranteeing a professional and reliable trading environment.

Regulation

Regulation

Regulation

Regulation

Audits

Audits

Audits

Audits

A platform you can

A platform you can

A platform you can

trust

trust

trust

trust

With the backing of renowned institutions such as Deutsche Börse and Commerzbank, we cultivate an environment of trust and reliability.

Regulated Service Providers only

Regulated Service Providers only

Regulated Service Providers only

Regulated Service Providers only

Infrastructure Security

Infrastructure Security

Infrastructure Security

Infrastructure Security

Access our latest

Blog Posts

Insights

Reports

Blog Posts

Insights

Reports

Blog Posts

Insights

Reports

Blog Posts

Insights

Reports

360X is vocal. Empower your trading decisions with the latest industry knowledge.

News

xStocks Launch on 360X, Extending the Leading Standard of Tokenized Equities to Deutsche Börse Group Clients

Launch underscores Kraken and Deutsche Börse Group’s partnership to bridge traditional and digital asset markets.

Company Announcement

Feb 9, 2026

News

360X Catalyzes a New Era of Capital Markets: Secondary Trading of Digital Assets is Gaining Ground by the Day

Revolutionizing capital markets: 360X facilitates the largest digital bond trade between DekaBank and Union Investment, proving a liquid on-chain secondary market is a reality. Our comprehensive infrastructure provides the critical 'plumbing' to connect disparate systems, breaking down silos and enabling seamless, compliant trading for all participants. Discover how we're building the future of digital finance.

Company Announcement

Aug 21, 2025

News

DekaBank, Union Investment, and 360X Set New Benchmark with DLT-Based Trade of Siemens Digital Bond

360X, DekaBank, and Union Investment complete the first-ever secondary market trade of Siemens' digital bond on a regulated venue. This landmark transaction establishes a compliant and liquid market for institutional DLT-based assets, setting a new benchmark for digital asset trading and accelerating on-chain capital markets.

Company Announcement

Aug 11, 2025

Blog Post

Regulated vs. Unregulated Exchanges: Navigating the Crypto Trading Landscape

Crypto trading options got you overwhelmed? Explore regulated vs unregulated exchanges. We unveil the pros & cons to pick the platform that fits your security & trading style.

Ben Keil / 360X AG

Apr 3, 2024

News

xStocks Launch on 360X, Extending the Leading Standard of Tokenized Equities to Deutsche Börse Group Clients

Launch underscores Kraken and Deutsche Börse Group’s partnership to bridge traditional and digital asset markets.

Company Announcement

Feb 9, 2026

News

360X Catalyzes a New Era of Capital Markets: Secondary Trading of Digital Assets is Gaining Ground by the Day

Revolutionizing capital markets: 360X facilitates the largest digital bond trade between DekaBank and Union Investment, proving a liquid on-chain secondary market is a reality. Our comprehensive infrastructure provides the critical 'plumbing' to connect disparate systems, breaking down silos and enabling seamless, compliant trading for all participants. Discover how we're building the future of digital finance.

Company Announcement

Aug 21, 2025

News

DekaBank, Union Investment, and 360X Set New Benchmark with DLT-Based Trade of Siemens Digital Bond

360X, DekaBank, and Union Investment complete the first-ever secondary market trade of Siemens' digital bond on a regulated venue. This landmark transaction establishes a compliant and liquid market for institutional DLT-based assets, setting a new benchmark for digital asset trading and accelerating on-chain capital markets.

Company Announcement

Aug 11, 2025

Have questions?

Find answers

Please do not hesitate to reach out to our team if you have any further questions or need assistance.

What does 360X offer?

360X's mission is to establish a liquid market for real-world assets that is both accessible and regulated. Presently, we provide a diverse array of instruments including eWps, DLT- and non-DLT financial instruments, and other electronic securities. You can explore the complete range of instruments upon onboarding to our platform. Please use the 'Request Demo' Button to get started.

What does 360X offer?

360X's mission is to establish a liquid market for real-world assets that is both accessible and regulated. Presently, we provide a diverse array of instruments including eWps, DLT- and non-DLT financial instruments, and other electronic securities. You can explore the complete range of instruments upon onboarding to our platform. Please use the 'Request Demo' Button to get started.

What does 360X offer?

360X's mission is to establish a liquid market for real-world assets that is both accessible and regulated. Presently, we provide a diverse array of instruments including eWps, DLT- and non-DLT financial instruments, and other electronic securities. You can explore the complete range of instruments upon onboarding to our platform. Please use the 'Request Demo' Button to get started.

What does 360X offer?

360X's mission is to establish a liquid market for real-world assets that is both accessible and regulated. Presently, we provide a diverse array of instruments including eWps, DLT- and non-DLT financial instruments, and other electronic securities. You can explore the complete range of instruments upon onboarding to our platform. Please use the 'Request Demo' Button to get started.

What is tokenization?

Tokenization of real-world assets involves converting tangible assets, such as real estate, fine art, or commodities, into digital tokens on a blockchain. These tokens represent ownership or a fraction of ownership in the underlying asset.

What is tokenization?

Tokenization of real-world assets involves converting tangible assets, such as real estate, fine art, or commodities, into digital tokens on a blockchain. These tokens represent ownership or a fraction of ownership in the underlying asset.

What is tokenization?

Tokenization of real-world assets involves converting tangible assets, such as real estate, fine art, or commodities, into digital tokens on a blockchain. These tokens represent ownership or a fraction of ownership in the underlying asset.

What is tokenization?

Tokenization of real-world assets involves converting tangible assets, such as real estate, fine art, or commodities, into digital tokens on a blockchain. These tokens represent ownership or a fraction of ownership in the underlying asset.

What assets can I invest in?

At our platform, you have access to a diverse range of investment opportunities. This includes all electronic securities (eWps) listed on our platform, as well as a comprehensive selection of additional electronic securities. Additionally, we offer DLT (Distributed Ledger Technology) and non-DLT financial instruments that are listed under paragraph 3 of section 4 of the eWpG (Electronic Securities Act). With this extensive range of options, you can tailor your investment portfolio to align with your goals and preferences.

What assets can I invest in?

At our platform, you have access to a diverse range of investment opportunities. This includes all electronic securities (eWps) listed on our platform, as well as a comprehensive selection of additional electronic securities. Additionally, we offer DLT (Distributed Ledger Technology) and non-DLT financial instruments that are listed under paragraph 3 of section 4 of the eWpG (Electronic Securities Act). With this extensive range of options, you can tailor your investment portfolio to align with your goals and preferences.

What assets can I invest in?

At our platform, you have access to a diverse range of investment opportunities. This includes all electronic securities (eWps) listed on our platform, as well as a comprehensive selection of additional electronic securities. Additionally, we offer DLT (Distributed Ledger Technology) and non-DLT financial instruments that are listed under paragraph 3 of section 4 of the eWpG (Electronic Securities Act). With this extensive range of options, you can tailor your investment portfolio to align with your goals and preferences.

What assets can I invest in?

At our platform, you have access to a diverse range of investment opportunities. This includes all electronic securities (eWps) listed on our platform, as well as a comprehensive selection of additional electronic securities. Additionally, we offer DLT (Distributed Ledger Technology) and non-DLT financial instruments that are listed under paragraph 3 of section 4 of the eWpG (Electronic Securities Act). With this extensive range of options, you can tailor your investment portfolio to align with your goals and preferences.

Who is eligible to invest?

Our trading infrastructure is exclusively available to Professional investors, including broker dealers, market makers, and issuers. These entities are provided access to our platform to engage in trading activities, ensuring a professional and regulated environment for investment. Please note that at this time, we currently exclude non-professional retail clients from accessing our services.

Who is eligible to invest?

Our trading infrastructure is exclusively available to Professional investors, including broker dealers, market makers, and issuers. These entities are provided access to our platform to engage in trading activities, ensuring a professional and regulated environment for investment. Please note that at this time, we currently exclude non-professional retail clients from accessing our services.

Who is eligible to invest?

Our trading infrastructure is exclusively available to Professional investors, including broker dealers, market makers, and issuers. These entities are provided access to our platform to engage in trading activities, ensuring a professional and regulated environment for investment. Please note that at this time, we currently exclude non-professional retail clients from accessing our services.

Who is eligible to invest?

Our trading infrastructure is exclusively available to Professional investors, including broker dealers, market makers, and issuers. These entities are provided access to our platform to engage in trading activities, ensuring a professional and regulated environment for investment. Please note that at this time, we currently exclude non-professional retail clients from accessing our services.

How can I tokenize my assets?

For inquiries regarding asset tokenization, please reach out to us via email at clients@360x.com

How can I tokenize my assets?

For inquiries regarding asset tokenization, please reach out to us via email at clients@360x.com

How can I tokenize my assets?

For inquiries regarding asset tokenization, please reach out to us via email at clients@360x.com

How can I tokenize my assets?

For inquiries regarding asset tokenization, please reach out to us via email at clients@360x.com

Stay updated on all things tokenized

Join our newsletter

Developer

Disclaimer: This material is the property of 360X AG and its affiliates. It is only provided to sophisticated investors for informational purposes and should not be construed as an offer, or solicitation of an offer, to buy or sell any interest or shares or to participate in any investment or trading strategy. It is also not intended to provide any accounting, legal or tax advice or investment recommendations. The material available on this website shall not be considered a solicitation or offering for any investment product or service to any United States person. The material offered by 360X through this website is not available for United States persons.

360X AG is regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin).

© 360X AG. All rights reserved.

Stay updated on all things tokenized

Join our newsletter

Developer

Disclaimer: This material is the property of 360X AG and its affiliates. It is only provided to sophisticated investors for informational purposes and should not be construed as an offer, or solicitation of an offer, to buy or sell any interest or shares or to participate in any investment or trading strategy. It is also not intended to provide any accounting, legal or tax advice or investment recommendations. The material available on this website shall not be considered a solicitation or offering for any investment product or service to any United States person. The material offered by 360X through this website is not available for United States persons.

360X AG is regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin).

© 360X AG. All rights reserved.

Stay updated on all things tokenized

Join our newsletter

Developer

Disclaimer: This material is the property of 360X AG and its affiliates. It is only provided to sophisticated investors for informational purposes and should not be construed as an offer, or solicitation of an offer, to buy or sell any interest or shares or to participate in any investment or trading strategy. It is also not intended to provide any accounting, legal or tax advice or investment recommendations. The material available on this website shall not be considered a solicitation or offering for any investment product or service to any United States person. The material offered by 360X through this website is not available for United States persons.

360X AG is regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin).

© 360X AG. All rights reserved.

Stay updated on all things tokenized

Join our newsletter

Developer

Disclaimer: This material is the property of 360X AG and its affiliates. It is only provided to sophisticated investors for informational purposes and should not be construed as an offer, or solicitation of an offer, to buy or sell any interest or shares or to participate in any investment or trading strategy. It is also not intended to provide any accounting, legal or tax advice or investment recommendations. The material available on this website shall not be considered a solicitation or offering for any investment product or service to any United States person. The material offered by 360X through this website is not available for United States persons.

360X AG is regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin).

© 360X AG. All rights reserved.